The Power of AI Credit Repair Tools: Build Your Credit with Ease

Maintaining a good credit score is like walking a financial tightrope. Miss one step, and you could be facing a steep drop in your score, which leads to higher interest rates, loan rejections, and other headaches. Between juggling credit card payments, disputing errors, and managing credit utilization, it can feel like a full-time job. But here’s the good news: with the rise of AI credit repair tools, you can take control of your credit with less effort, greater efficiency, and more success. These tools can generate dispute letters, help remove public records, and even manage credit card payments for you—all while boosting your chances of financial stability.

And the best part? You can get started for free. Let’s explore how AI credit repair tools can help you build credit and take control of your financial future.

Why Building Credit Is So Hard

If building good credit was easy, everyone would have an 850 credit score, right? But the truth is, credit repair is more complicated than just paying your bills on time. Here’s a quick look at what makes it so tough:

- Disputing Errors: Credit report inaccuracies are surprisingly common. Everything from collections you’ve already paid to wrong account information can sneak into your report, damaging your score.

- Managing Public Records: Tax liens, bankruptcies, and other public records can linger on your credit report for years and drag your score down.

- Credit Utilization: Using too much of your available credit—even if you pay it off each month—can still hurt your score.

- Staying on Top of Payments: With multiple credit cards and payment deadlines, it’s easy to forget a due date, which can lead to late fees and a dent in your credit score.

All of this adds up to a complicated, often frustrating process that can feel like it’s out of your control. But this is where AI comes in to help you take charge of your credit with smarter tools.

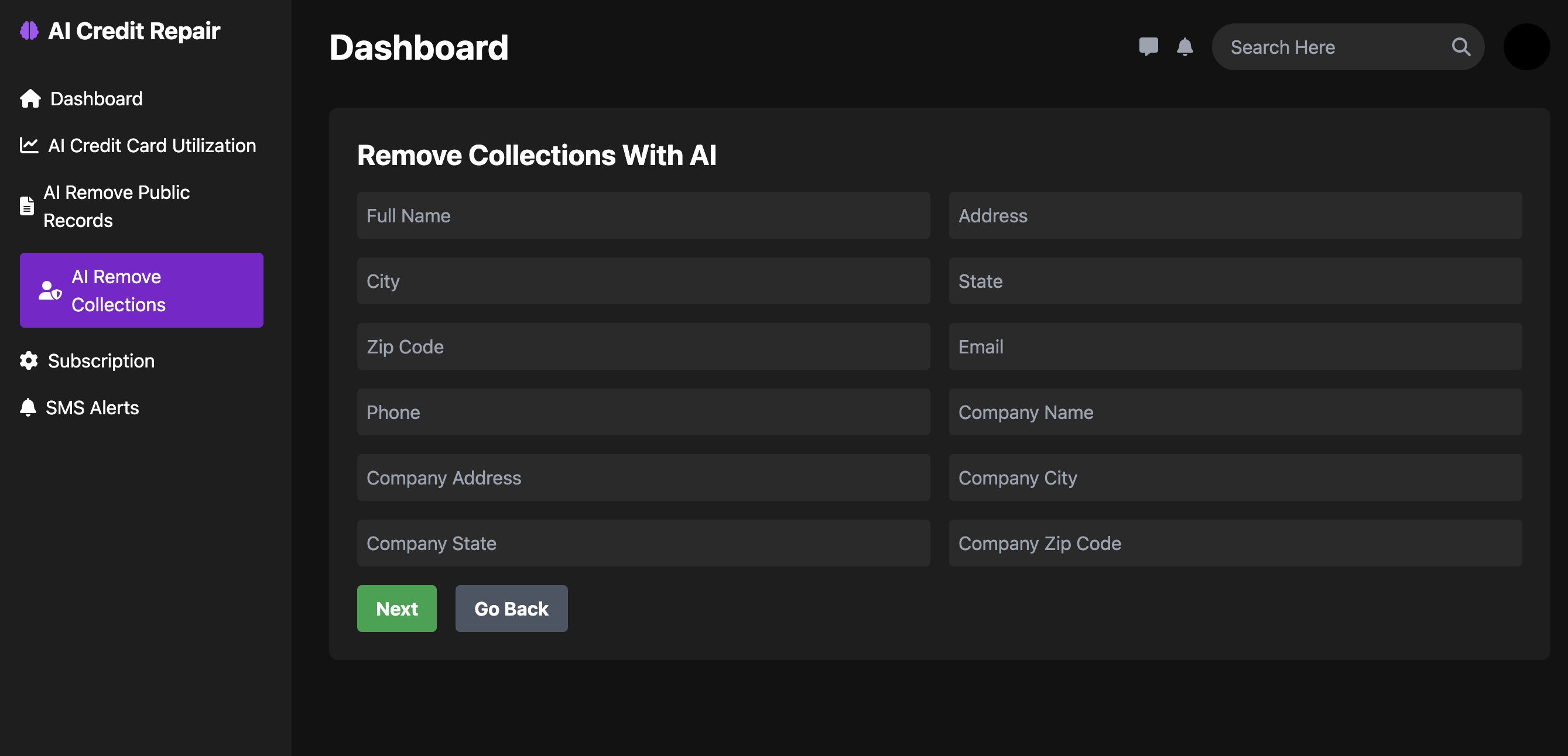

How AI Credit Repair Tools Simplify the Process

Imagine having an intelligent assistant who knows exactly what to do to boost your credit score. That’s what AI credit repair tools offer—automated solutions that take care of the hard work for you. Here’s how they can help:

Generate Dispute Letters For Free

One of the most useful features of AI credit repair tools is the ability to generate dispute letters for free. Disputing errors on your credit report is crucial for improving your score, and with AI, you can quickly generate professional dispute letters to send to credit bureaus. These letters are crafted to challenge inaccuracies like late payments, unpaid collections, or accounts that don’t belong to you.

Better yet, AI can upgrade to a more sophisticated model that tailors the letter to your specific issue. This model takes relevant laws into account, giving your dispute a solid legal backing and improving your chances of success. It’s like having a personal credit attorney on your side—but for free (or at least much cheaper).

Remove Public Records with Ease

Public records like bankruptcies, tax liens, and judgments can devastate your credit score. Removing them often feels impossible, especially if you don’t know where to start. However, AI tools are designed to help you remove public records by identifying inaccuracies or outdated information.

AI-driven tools know the exact processes to follow and will guide you step by step on how to dispute public records effectively. Plus, with legal backing included in the dispute letters, you’ll have a much better shot at cleaning up your report.

Manage Your Credit Card Utilization

Most people don’t realize that credit card utilization plays a huge role in your credit score. Even if you’re diligent about paying off your balance each month, using too much of your available credit can negatively affect your score. AI credit tools can help you manage your credit utilization by analyzing your spending habits and suggesting optimal usage.

For instance, they can recommend spreading your spending across multiple cards, or paying off balances before they’re reported to credit bureaus. By managing utilization with AI’s help, you can boost your score without having to drastically change your lifestyle.

Stay On Top of Payments with Reminders

Forgotten payments can lead to late fees and score reductions, but with AI, that becomes a thing of the past. These tools can send you SMS text reminders when your credit card payments are due, helping you avoid those costly missed payments.

This simple but effective feature is like having a personal assistant who makes sure you never forget to pay your bills. You’ll stay accountable, and your credit score will thank you for it!

Dispute Letters Backed by Legal Authority

One of the standout features of AI credit repair tools is their ability to create dispute letters backed by legal authority. These are not your generic templates that may or may not work. Instead, AI can generate dispute letters that cite specific laws and regulations relevant to your case.

For example, if an old debt is still on your report even though it’s past the statute of limitations, the AI will include that law in your dispute letter. This significantly increases the chances that the credit bureaus will take your claim seriously, leading to a faster and more favorable resolution.

These legal-backed letters show creditors and credit bureaus that you mean business, and that you’re not just another consumer sending off a form letter. They add authority to your disputes, making it much harder for anyone to ignore or dismiss your claims.

Get Started For Free – Build Your Credit Today

The beauty of these AI credit repair tools is that you can get started for free. Whether you’re just looking to generate a simple dispute letter or you want comprehensive credit management, there’s no need to spend a fortune. Many of the basic features are available at no cost, and if you decide you need more advanced options, you can always upgrade for additional support.

Even with the free tools, you’ll have everything you need to start improving your credit right away. The AI will handle the hard work—generating letters, analyzing your credit utilization, and sending payment reminders—so you can focus on enjoying the benefits of a stronger credit score.

Conclusion: Take Control of Your Credit with AI

Credit repair doesn’t have to be an overwhelming, time-consuming process. With AI credit repair tools, you can automate much of the work and significantly increase your chances of building a strong, healthy credit score. From generating legally backed dispute letters to managing credit utilization and sending payment reminders, these tools provide everything you need to take control of your financial future.

So why wait? Get started for free today and see how AI can transform your credit score. With the right tools, building and maintaining good credit is finally within reach.

Comments on “Article”